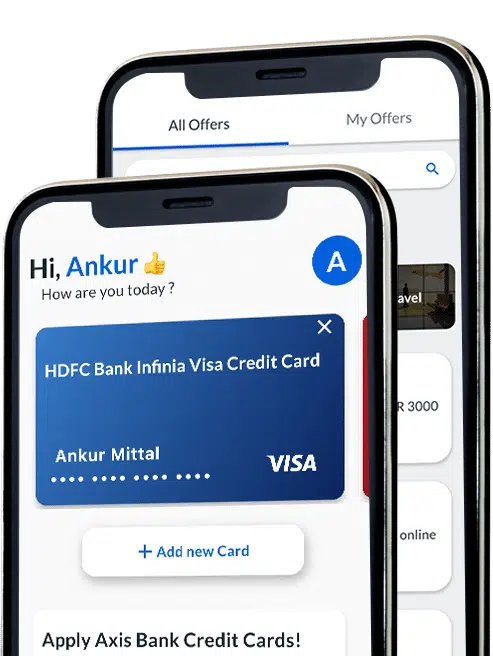

Most Popular Credit Cards in India

Do you want to know which of the credit cards are the most popular? Why not take a look and see how they stack up against each other.

Our Partners

We partner with all major credit card issuers to make sure you see as many great offers as possible.

Credit Card News & Offers

Keep up with the latest trends and offers from our experts. Read the articles to keep yourself updated!

ITC Hotels, in association with American Express Credit Cards, have rolled out some new offers for their clients.…

For people who always dreamt of owning a luxury car, American Express in association with Audi has launched…

SBI Card offers a new and exciting deal for its existing credit card holders. For a limited time,…

American Express has introduced new discounts for travelers using the AmEx card. Cardholders can book flights through Yatra’s…

American Express is aggressively promoting their Charge credit cards (Platinum and Gold cards) in India. They have been…

IndusInd Bank credit cards are highly popular in the country due to their rewarding offers and benefits. With…

Credit Card Guides & Tools

There are so many credit cards in the market, and it can be hard to know which one is right for you. Luckily, these guides will help!

With so many credit cards in the market, choosing the one that’s right for you can be overwhelming. Each card has unique features, benefits, and fees, and it’s essential to understand them before deciding. Credit cards have become an integral part of our financial lives. They offer convenience, security, and…

An individual’s credit history of borrowing and repaying money is recorded in their credit score. A high credit score allows people to borrow money at reduced interest rates and to be qualified for any type of credit they might need. Banks and financial institutions consider credit scores thoroughly before they…

Using a credit card can be convenient and helpful for making purchases, but it is important to be cautious to protect yourself from card fraud and theft. Credit card safety involves taking steps to keep your card information safe from unauthorized access. Activities like credit card fraud, and identity theft…

The credit card has a plethora of advantages and disadvantages. On the one hand, it can prove to be a boon, and on the other hand, it can be a ban for credit cardholders. There are endless advantages of using a credit card; they offer reward points on spending, convenience…

A credit card is a payment card issued by a bank or NBFC that offers cardholders a line of credit to make purchases. Credit card holders must pay back the borrowed money to the bank or issuing authority within a given period. Credit cards have become an integral part of…

Have you ever thought of how all the payments made with your credit card work? How and why do your banks pay for your purchases? Credit card networks are what make all these things possible by working behind the scenes. Before having a credit card, you notice a lot of…

Airport Lounge Access With Card Insider

Check out the lounges you can access with your credit card at any airport in India